#4 Medicare Part I: How it works

Medicare and Medicare Advantage: it's complicated! Here's a quick guide to the key mechanics of the program.

I can think of three reasons why everyone, particularly those interested in Agetech in the US, should have a basic understanding of how Medicare works:

It is the main health insurance program for anyone above 65 years old in the United States, and about 89% of this age group participates. This translates to about 68 million enrollees today (link).

Due to #1 being true, Medicare is the main path to reimbursement for anyone working on a medical/health-related solution targeted to an older population (in other words, Medicare is the main way that you can avoid having the consumer pay for your product, and have the solution paid for by Medicare instead).

Due to #1 being true, the federal government spends a lot of money on Medicare each year. In 2023, the Medicare program cost $839B, about 14% of total federal government spending and over one-fifth of all health spending (link).

Despite its importance, Medicare is a labyrinth to decode. In this post, I will attempt to walk through the basic mechanics of the Medicare program. I will go light on the research and statistics of how Medicare is performing and leave that for my next post. Instead, here I’ll focus purely on the nuts and bolts of how it all works.

This is not meant to be a comprehensive guide, nor a resource for those actually looking to select their Medicare program (I recommend Medicare.gov for this), but more for someone who is doing research on the space and wants a cheat sheet or launching pad to dig deeper.

The Two Sides of Medicare: Original Medicare vs. Medicare Advantage

To make things easy, there are two very different ways that Medicare is offered — Original Medicare and Medicare Advantage. We will walk through each program individually, but the two programs are fundamentally different in how they are administered and the mechanics that govern each.

For now, you can just note that:

Original Medicare (also known as Traditional Medicare or just “Medicare”) is administered directly by government, specifically by the Centers for Medicare and Medicaid Services (CMS), a branch of the US Department of Health and Human Services (HHS). Some aspects of Original Medicare are also outsourced to private companies and we will point out how later.

Medicare Advantage (or “MA”) is a Medicare-approved plan that is administered completely by private companies. This is an alternative for consumers to Original Medicare’s coverage.

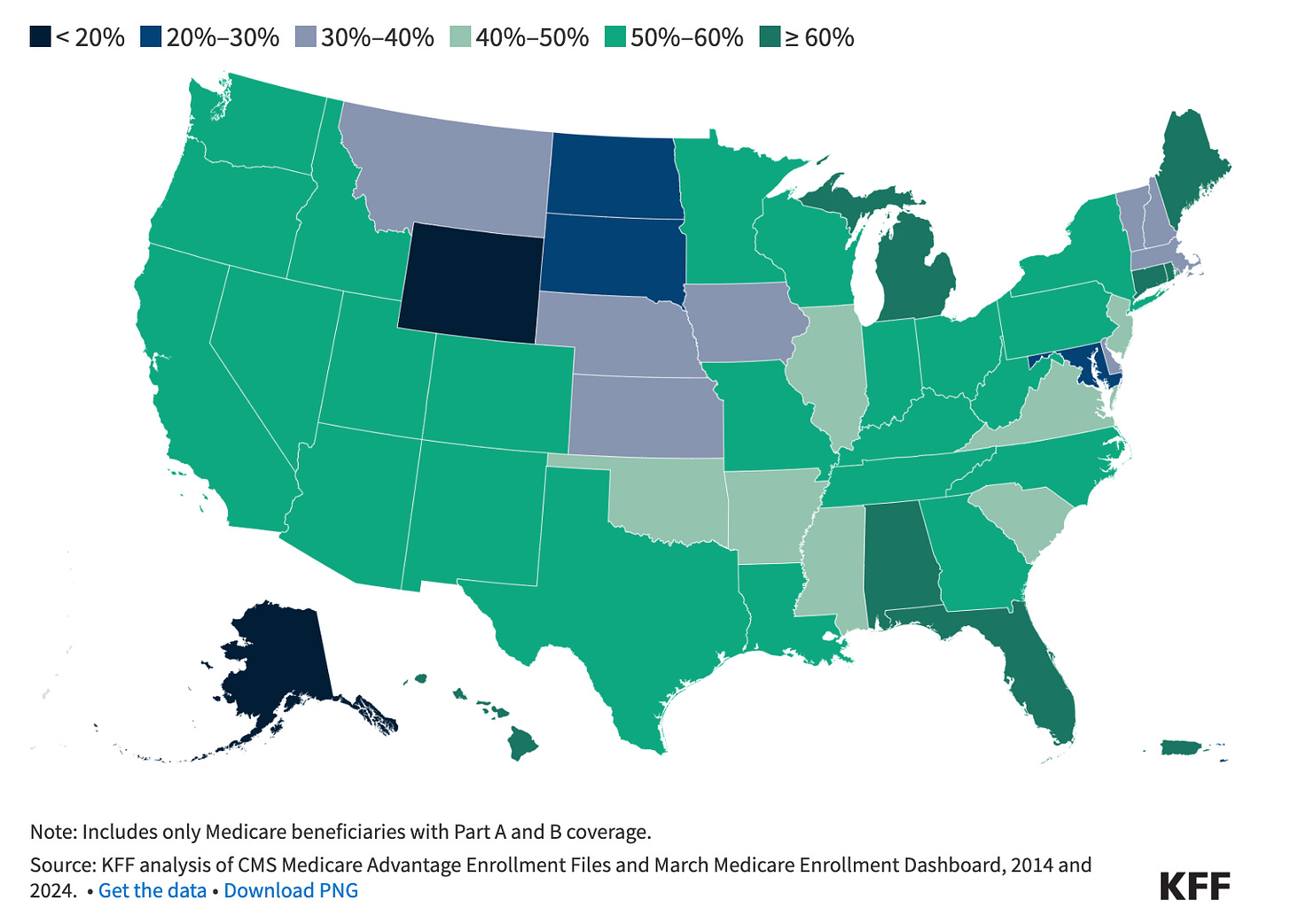

In 2024, enrollment in MA plans slightly exceed that of Original Medicare, and about 54% of enrollees are enrolled in MA plans as opposed to Original Medicare (link). The distribution varies slightly state-by-state.

How Original Medicare works

Coverage

Original Medicare consists of three parts: Part A, B, and D. In case you are wondering, Part C corresponds to Medicare Advantage, originally called "Medicare+Choice”.

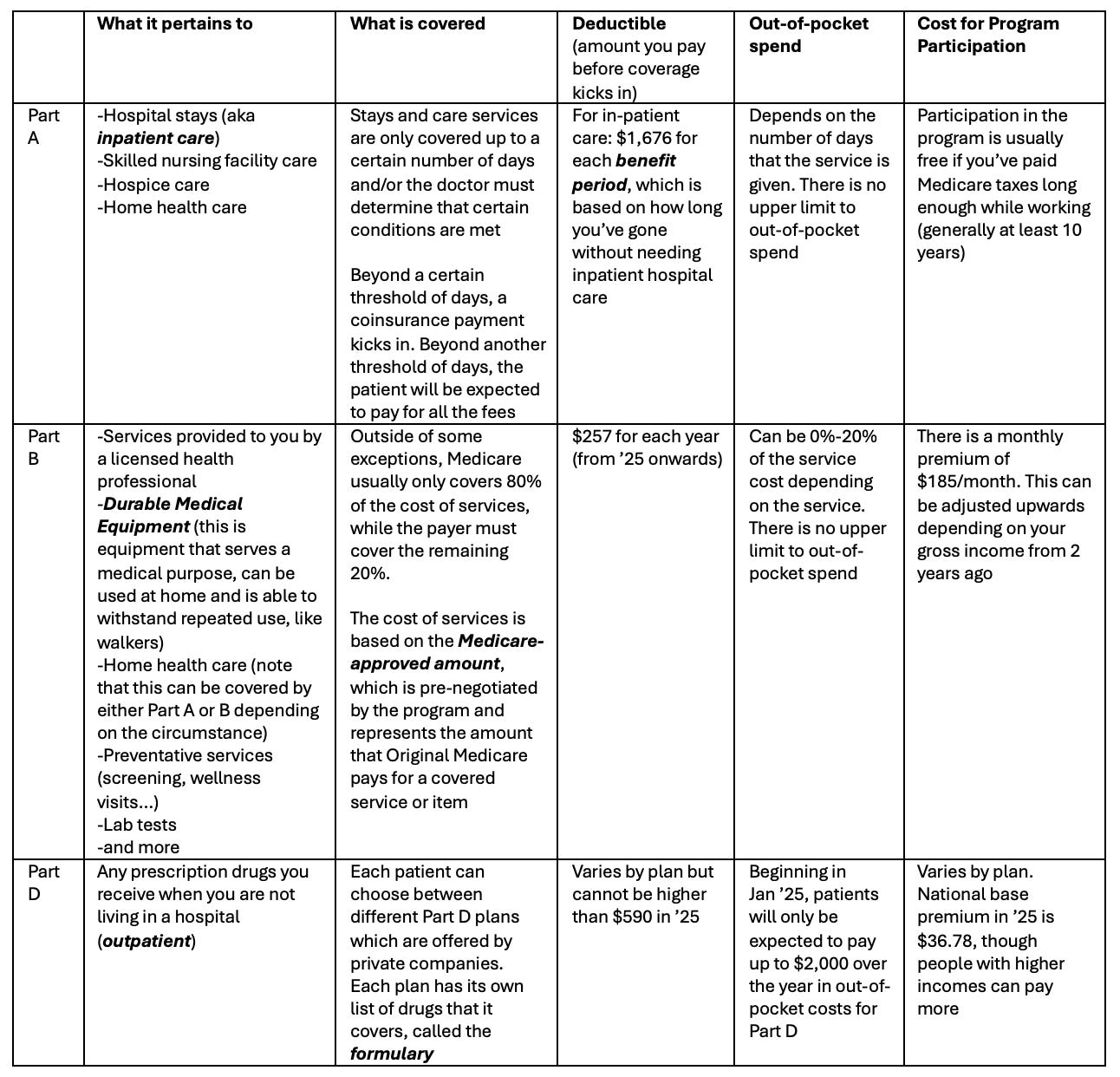

The table below gives a high-level view of how coverage works in each of these categories, but there is a lot of subtlety that is not captured for the purposes of brevity in this post. If you wish to dig deeper, I recommend the following resources: Medicare Interactive and Medicare.gov.

Out-of-pocket expenses

Unlike most health insurance policies, Part A & Part B of Original Medicare has no limit on out-of-pocket spending. To limit the risk of catastrophic medical costs, enrollees can buy Medigap. Medigap is extra insurance that you can buy from a private company that can help pay the helps you pay your share of costs in Original Medicare’s Part A and Part B. Medigap kicks in after you have met your deductible and typically has an additional premium associated with it. The average monthly premium among current Medigap policyholders was $217 in 2023, or $2,604/year (link).

Participating Healthcare providers

Virtually all (98%) of non-pediatric physicians participate in the Medicare program. Psychiatrists account for the largest share (39.0%) of all non-pediatric physicians who have opted out of Medicare in 2024, followed by family medicine physicians (21.5%) and internal medicine physicians (13.0%) (link).

How Original Medicare works with Health Care Providers

Enrollees can receive care at any Medicare-certified group. The facility or provider then submits a report of their costs to Medicare Administrative Contractors (“MACs”) for processing and reimbursement determination. This auditing process occurs after the service has been conducted. MACs are private health insurers that receive contracts from CMS to process Medicare claims.

Original Medicare is also sometimes called fee-for-service (“FFS”) Medicare because the government pays providers directly based on a predetermined fee schedule or system (also know as the Medicare-approved amount). Medicare-approved amounts are lower, on average, than payments from private insurers (link).

How Medicare Advantage works

Coverage

MA plans are required to provide all medically necessary services that Original Medicare provides. An exception is hospice care, which would still be covered by Original Medicare even if you are enrolled in a MA plan.

While Original Medicare requires enrollees to select a separate plan to cover prescription drugs (Part D), MA plans typically include them.

MA plans may also offer supplemental benefits that are not covered in Original Medicare, such as dental care, gym memberships, and hearing aids.

Types of MA programs

There are multiple different flavors of MA programs, but there are two main types that most people are enrolled in:

Health Maintenance Organizations (HMOs): Enrollees are limited to the providers in the plan’s network. When they get health care outside of the plan’s network, they may have to pay full cost.

Preferred Provider Organizations (PPOs): Enrollees pay less if they go to providers and facilities that belong to the plan’s network, but can also go to out-of-network providers for covered services, though they may have to pay more. PPOs can be either local (serves one or more counties) or regional (serves one or more states).

Aside from these two, there are other types of MA programs as well. One example is Special Needs Plans (SNPs) that provide benefits and services to people with specific severe and chronic diseases. All SNPs use a care coordinator to develop a care plan for the patient.

Out-of-pocket expenses

Since 2011, MA plans are required to provide out-of-pocket limits for services covered under Part A and Part B. In 2024, the out-of-pocket limit for Part A and B services for MA plans may not exceed $8,850 for in-network services for (HMOs, and for PPOs if only in-network services are used) and $13,300 for in-network and out-of-network services combined (for only PPOs, when out-of-network services are used) (link). Like Original Medicare, out-of-pocket costs for prescription drugs are capped at $2,000/year starting from ‘25 (link).

How private companies are paid for running MA programs

On a basic level, the government pays MA plans a set rate per person per year that is assumed to cover the full cost of providing coverage for the individual for that year (these are called capitation payments).

However, there is a lot of nuance on how much the government actually pays:

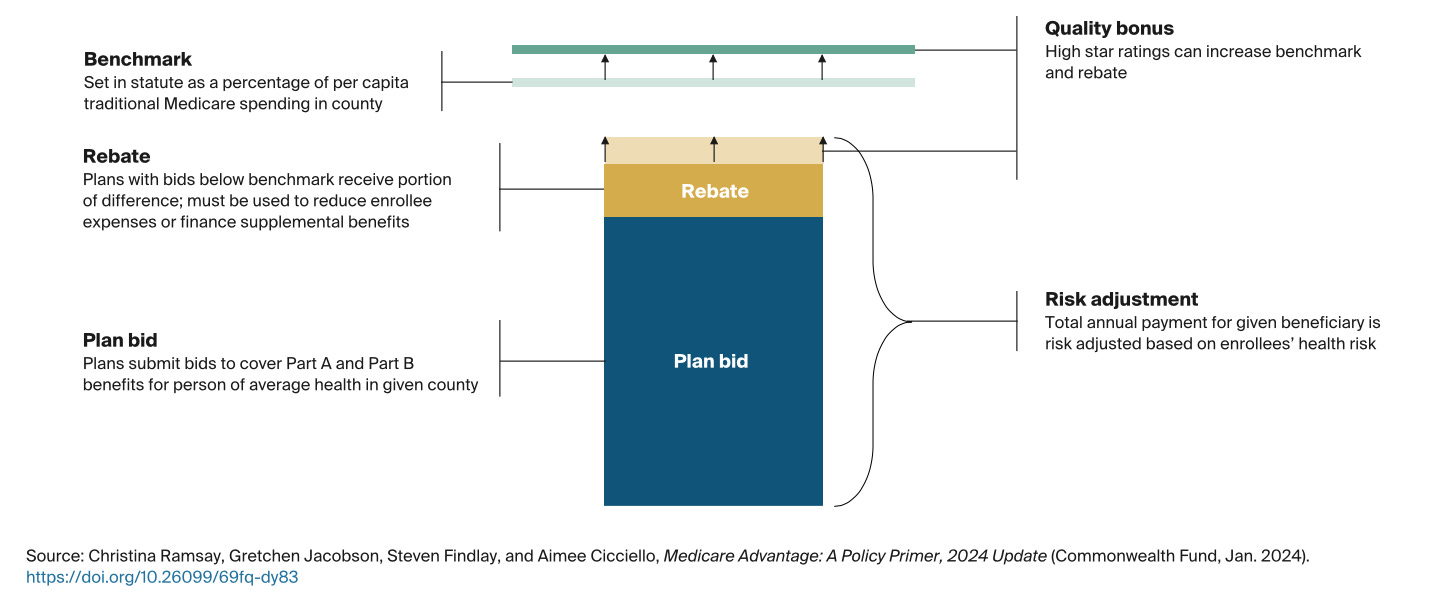

Benchmark and Bidding: Every county has a slightly different plan benchmark, which is the maximum amount the federal government will pay a MA plan (this ranges from 95%-115% of average Original Medicare spending). Each MA plan submits a bid for how much the plan thinks it would take to cover Plan A & B benefits for a person of average health in that county.

If the bid is below the local benchmark (which is the case for the majority of the plans), the plan keeps part of that difference as a rebate. Plans are required to use the rebate to lower patient cost sharing, lower premiums, or provide some coverage for benefits not included in Original Medicare. Rebate dollars can also be used to pay for administrative expenses and profits associated with providing additional benefits.

If the bid is above the local benchmark, the plan can charge a premium for coverage of Part A & B benefits.

Even if a plan bids below the local benchmark and receives rebates, it can still charge premiums for supplemental benefits and Part D coverage.

Risk Adjustment: Rebates, along with the bid amount, are adjusted for the enrollee’s health status. Patients with certain diagnosed conditions cost more to treat and hence MA plans will receive higher rebates for enrolling them.

Quality Adjustment: Quality is calculated under the Quality Rating System ran by CMS, and impacts the rate calculation in two ways: 1) Higher quality plans benefit from increased plan benchmarks by 5-10%, and 2) lower quality plans receive a smaller portion of the difference between the bid and the benchmark as rebate compared to higher quality plans (this ranges from 50-70% of the difference).

Medical loss ratios: Medicare Advantage and Part D prescription drug plans are required to have a medical loss ratio of no lower than 85 percent. This means that plans’ administrative expenses and profits, or margins, can be no higher than 15 percent of the total revenues that plans receive from the federal government and enrollees. Plans that do not meet this requirement must remit payments to CMS.

How MA works with Health Care Providers

Unlike Original Medicare, MA insurers frequently require patients and providers to obtain prior authorization before receiving care for some treatments and services. Prior authorization is essentially a process that health insurance companies use to determine if they will cover a medical treatment, prescription, or service. A denial often forces a patient to pay for the service out-of-pocket, or forgo it entirely if they can’t afford it. Patients have the right to appeal denials but in 2022 less than 10% of denials were appealed (link).

Also unlike Original Medicare, MA plans don’t pay the Medicare-approved amount and instead negotiate price with clinicians independently (link).

Conclusion

With all this information in hand, hopefully you feel more confident about your understanding of Medicare and Medicare Advantage!

Despite this post is already a bit too long, we have only just scratched the surface. In my next post, we will look at some of the statistics and research on the program to better understand how Medicare and Medicare Advantage are functioning in practice.

Let me know if you have any questions or feedback and stay tuned for Medicare Part II: How it’s working.

Sources:

U.S. Senate Committee on Homeland Security & Governmental Affairs. 2024. Majority Staff Report on Medicare Advantage. October 17, 2024. https://www.hsgac.senate.gov/wp-content/uploads/2024.10.17-PSI-Majority-Staff-Report-on-Medicare-Advantage.pdf.

Commonwealth Fund. 2024. Medicare Advantage Policy Primer. January 2024. https://www.commonwealthfund.org/publications/explainer/2024/jan/medicare-advantage-policy-primer.

Medicare.gov. Your Health Plan Options.

https://www.medicare.gov/health-drug-plans/health-plans/your-health-plan-options.

Commonwealth Fund. 2024. Medicare Advantage Policy Primer. January 2024. https://www.commonwealthfund.org/publications/explainer/2024/jan/medicare-advantage-policy-primer.

JAMA Internal Medicine. 2017. Original Medicare vs. Medicare Advantage: Key Differences. https://jamanetwork.com/journals/jamainternalmedicine/fullarticle/2643349.

Medicare Interactive. Original Medicare Coverage Overview. https://www.medicareinteractive.org/get-answers/medicare-basics/medicare-coverage-overview/original-medicare.

Medicare.gov. Medicare Costs Overview. https://www.medicare.gov/basics/costs/medicare-costs.

Oh, my, you did not lie… that is brain bending! 🤯 How on earth will seniors with cognitive impairment understand this?!?